Electric Vehicles are in the news right now. The new spending bill that just passed through Congress affects the purchase of these vehicles and charging stations. In addition, the bill may have an impact on your future business decisions.

How can electric vehicle charging stations benefit you? What legislative decisions will also affect you?

Electric Vehicles (EV) and the New Spending Bill:

• Expiration of Tax Credit for EV Purchases : Currently, individuals who purchase an electric vehicle receive a $7,500 tax credit for new vehicles and a $4,000 tax credit for used vehicles. These tax credits will expire on September 30, 2025.

• Possible Effects of Expiration: EV owners are loyal and largely happy with their purchases. There is likely to be a surge of demand and purchases of EV’s up to the expiration date. There may also be interest and inquiries regarding nearby charging stations.

• Electric Vehicle Charging Stations: There was also a tax credit through the Alternative Fuel Vehicle Refueling Property Tax Credit. This tax credit, limited to $100,000, offered incentives to businesses that installed charging stations. Many business owners took advantage of this credit. This included gas station and convenience store owners, retail and commercial office space owners, multi-family housing owners and hospitality owners.

• When is the EV Charging Station tax credit expiring? This tax credit is due to expire on June 30, 2026.

• Should I Install an EV Charging Station? Our lenders are aware that business owners may be keen to take on this business upgrade with some urgency. In addition, if you are in the market to purchase or refinance commercial real estate, you may want to include a charging station installation in your business plan. While it is difficult to predict the cost-benefit of a charging station, it is certainly advantageous to install the station before the tax credit expires. t

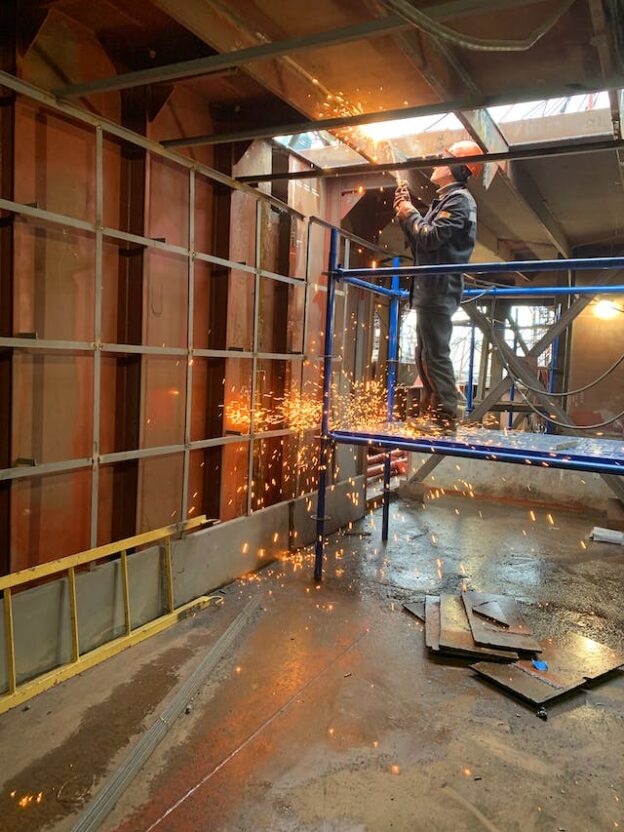

Our GRP Capital team specializes in finding the right lender for each project. We save our clients time and money, as we research the best choices for their funding sources. Our experience allows our clients to find funding that is project-appropriate and will allow for sufficient cash flow. Whether you are looking to refinance or purchase or engage in construction, we would love to discuss your business plans with you. If you are considering becoming a first-time (or second or third time!) buyer, we can assist you.

Get Started

Get Started