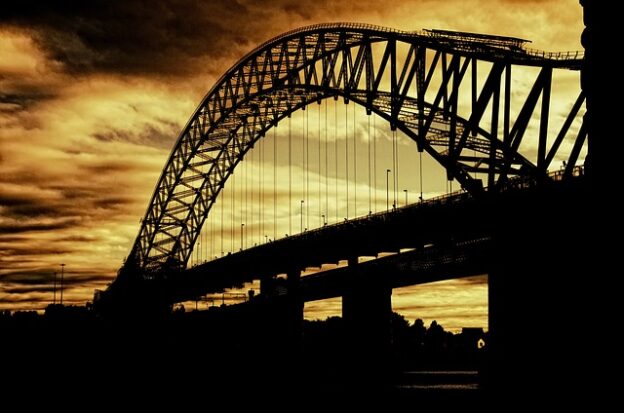

Our Texas borrowers came to us last year, needing a bridge loan. We accomplished that.

Then we turned our attention to sourcing permanent, affordable financing. And now we accomplished that!

Looking back over the whole process reminds us of all of the challenges that can occur between origination and closing.

The First Goal: Secure Emergency Bridge Loan Financing.

Our clients had their eyes on an upper moderate hotel in South Texas. They had chosen their lender. But this story almost didn’t have a happy ending. Their lender dropped the loan in the middle of underwriting!

Lender dropout is a real problem and it is becoming more common in the current economic climate. And even more upsetting, the seller was adamant about the timeline: no extensions!

The buyers came to us in a bit of a crisis. They needed a loan fast!

Rick Patel and Krishan Patel worked closely with the client partnership group. First GRP Capital recommended a restructuring of the loan. As a result, traditional lenders would be more willing to finance it. But, being realistic, our team recommended a bridge loan. Bridge financing is a short term loan, designed to bridge the gap between undertaking financing and finding a permanent financing product. Bridge loans can be the perfect solution when the loan absolutely has to close, but the clients need more time to get everything right.

The Second Project: Permanent Financing

Once the bridge loan was in place, it was imperative to find permanent financing for our clients. Bridge loans are expensive. As a result, they are a stop-gap, temporary measure.

Ultimately, with some more time, we were able to secure a permanent loan for our clients. In the meantime, they even sustained some hurricane damage. This still did not stop the closing. However, it was a bit delayed while insurance companies reevaluated the situation.

The moral of the story is that hard work and patience and strong financial advice do win out in the end.

Bridge Loan Basics:

• Short-term financing that has to stay short-term. Bridge lenders are interested in short-term financing only. They want to know that clients have an exit strategy to obtain permanent financing.

• Premium comes with a price. Bridge lending has a built in cost, usually a higher interest rate. This is another inducement to find permanent financing quickly.

• Be prepared for careful underwriting: Bridge loans are a somewhat riskier product for the lender, so lenders will work to protect themselves. They will conduct their own underwriting and it will be quite similar to a conventional lender’s underwriting protocol. Bridge lenders want to ensure that your loan will be able to be funded elsewhere pretty quickly. So they will look at your loan structure, your cash positions and your debt coverage before offering even this emergency financing.

Our GRP Capital team specializes in finding the right lender for each project. We save our clients time and money, as we research the best choices for their funding sources. Our experience allows our clients to find funding that is project-appropriate and will allow for sufficient cash flow. Whether you are looking to refinance or purchase, we would love to discuss your business plans with you. If you are considering becoming a first-time (or second or third time!) buyer, we can assist you.

Get Started

Get Started